Interest rates on hold for Christmas & inflation trending downward

The Reserve Bank announced interest rates would remain on hold today and given there is no RBA meeting in January it means rates are on hold until at least February 2024 now. This is great news for Christmas and New Year as mortgage holders can have...

The Reserve Bank announced interest rates would remain on hold today and given there is no RBA meeting in January it means rates are on hold until at least February 2024 now.

This is great news for Christmas and New Year as mortgage holders can have some peace of mind about their loan repayments and relax somewhat over the festive holiday period.

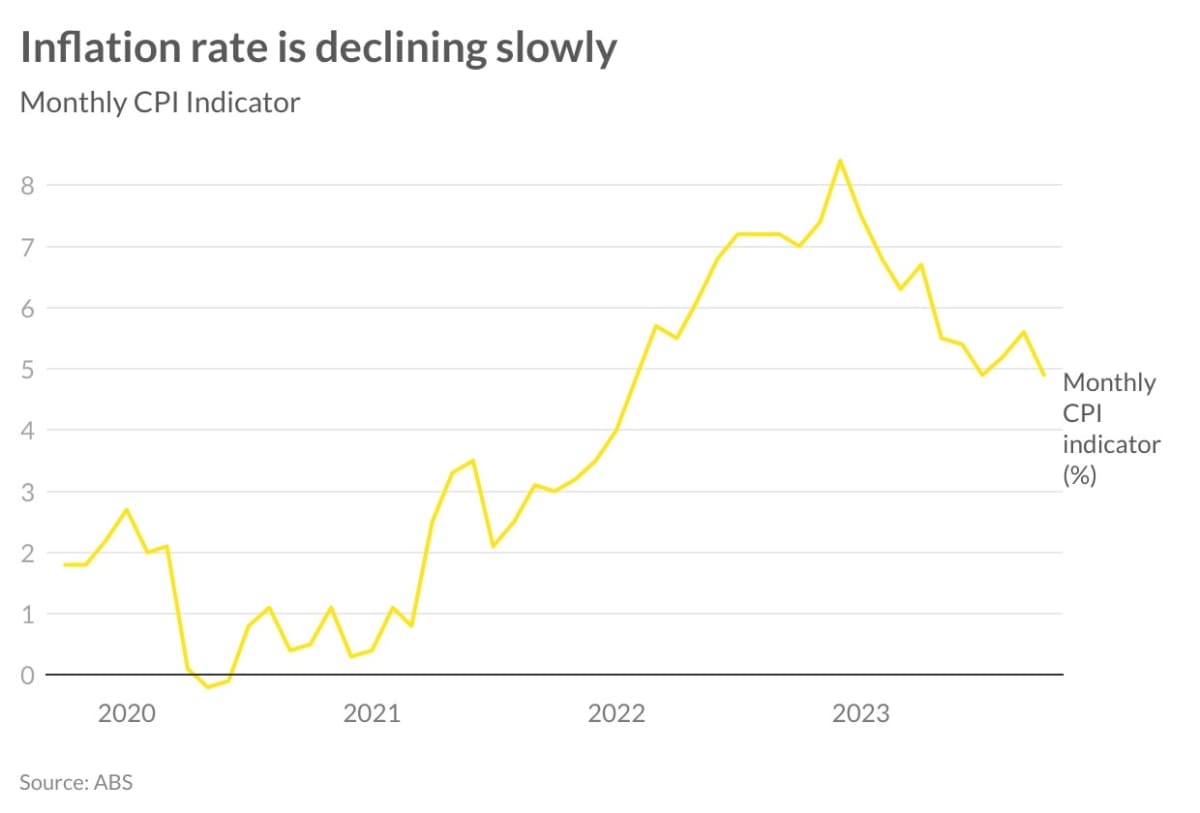

The main reason for the decision was the recent economic news on inflation, which for the 12 months to October 2023 was 4.9%. While this is still above the RBA’s target it is continuing to show a downward trend seen below in the graph.

In other developed countries, such as the US and UK, inflation has been trending even lower with the rate hikes there, so overall the news is positive that rates have peaked and the next move could be down. When is anybody’s guess but likely consensus is sometime in late 2024.

In our local market, there has been a surge in sales indicating the market is still resilient to the rate rises of the past year and the strong appeal of a coastal lifestyle still alive and well.

- 6/14 Raymond Rd, Thirroul sold $1,180,000 by Ian Pepper at Ray White

- 24 The Crescent, Helensburgh sold $1,360,000 by Ron Kissell at Ray White

- 14 Railway Crescent, Stanwell Park sold $1,800,000 by Mattias Samuelsson & Ian Pepper

- 5 Wigram Rd, Austinmer sold $1,950,000 by Peter Armstrong at AM Rutty

- 7 McCauley St, Thirroul sold $2,800,000 by Venessa Denison-Pender at McGrath

- 2C Pass Ave, Thirroul sold $2,100,000 by Andrew Hedley at One Agency