Rate increase next week and sales showing price reductions

Inspection numbers were down over the past weekend, with beautiful weather and more rate rises potentially looming. More inflation and economic data due out this week should give more indication of the RBA’s next move at the March meeting on...

Inspection numbers were down over the past weekend, with beautiful weather and more rate rises potentially looming. More inflation and economic data due out this week should give more indication of the RBA’s next move at the March meeting on Tuesday 7th.

Despite the gloomy outlook with regard to interest rates, a higher number of sales took place over the past few weeks compared to previous months. A number of notable sales are below:

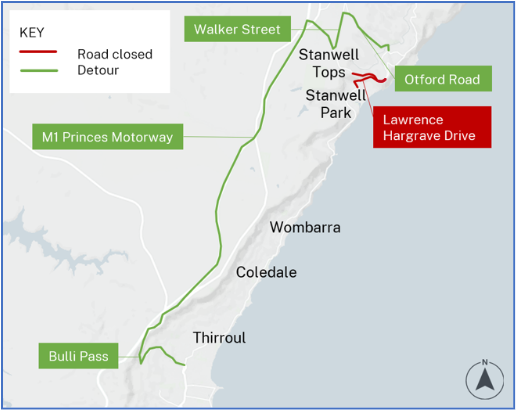

- 56A Lower Coast Road, Stanwell Park – $3,300,000 by Mattias Samuelsson from Ray White Helensburgh

- 1 Saywell Place, Wombarra – $2,660,000 by Troy McNeice from Molenaar & McNeice

- 764 Lawrence Hargrave Drive, Coledale – $2,000,000 by Dalton Stewart from AM Rutty

- 2 Boswell St, Helensburgh – $1,510,000 by Murray Kennedy Real Estate

- 96 Undola Road, Helensburgh – $1,305,000 by Julie York from Raine & Horne Helensburgh

These sales are all at prices reduced from their initial marketing, most notable being 1 Saywell Place, which had a price guide of $3,950,000 as at 28 January 2023 and sold for $2,660,000 on 14 February, only a few weeks later. That’s a price reduction of 32.6%!

Discussion continues around valuation objections from the recently received valuation assessments from the NSW Valuer General. The feedback and comments indicate most valuations have increased over and above actual market price movements, which is a major concern for most locals. Unfortunately, at this stage it appears from anecdotal evidence that most of these objections have been disallowed, leaving only an appeals process to those wishing to continue to object.